Scams and fraud — How well are you protected?

I got a speeding ticket in my first new car. Headed to traffic school to avoid a point on my license. The only thing I remember from the class was this question from our instructor. “Raise your hand if you think you are a better than average driver.” And the response! So, switch to today. . .

Raise your hand if you think you are better than average at detecting scams and fraud.

In researching for this article, I came across so many interesting statistics! Three of my favorites:

- Around half of people contacted by a scammer engage with them. (Better Business Bureau)

- In general, the older the victim, the more money they lose. In 2021, average loss of senior victim was $18, 246! (FBI)

- But younger people are twice as likely to be scammed as older people – because they respond without thinking to online offers!

Even if you don’t fall into any of these categories, you should be aware that losses to fraud are going up FAST! (70% increase in 2021!)

So it seems to be the right time for a review of what’s been working for scammers. The more you know about latest developments, the better protected you’ll be.

Let’s start with a couple of very basic “tests” to see how aware you really are.

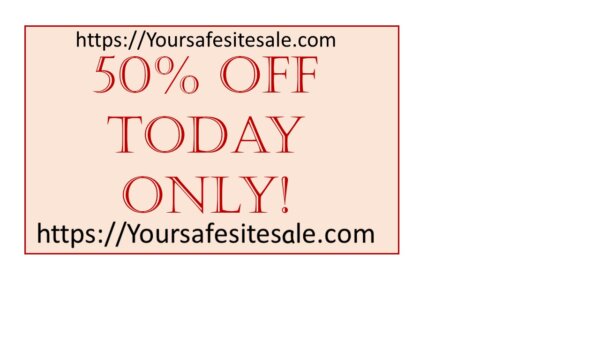

You’ve been searching for a new jacket online. You start seeing “retargeting” ads — the ones that follow you based on earlier searches. Suddenly up pops an add for your favorite jacket at an amazing 50% off – today only! Limited supply!

You go for it! The link takes you to a familiar-looking website. You fill in your credit card and get the purchase confirmation. Everything seems fine . . . until that jacket never arrives. Your credit card account has been maxed out. And nowhere do you find a “customer service” number for help!

Let’s examine this scam example to see what you might have missed.

Of course, if you were among the “better than average” online shoppers, you might already have checked for these.

Test #1: Does the website name start with http:// or with https:// ?

HTTP, the “Hyper Text Transfer Protocol,” carries data between your browser and the website you are connected to. When “S” is added, that means a security layer has been added via encryption. Every legitimate website that “sells” things, or that collects personal information, should have this secure protection. (It’s easy to add; the cost varies depending on what level of security is required.)

Test #2. Are you really at the right website?

Because you’re one of the experts, you’ve noted whether the site you arrive at is Yoursafesitesale.com or –Whoops !– should it actually be Yoursafesitesale.net?

Test #3. Look again. Are you really at the right website?

Finally, you take just one more look to be sure that this is actually the site you thought you were going to. The name of the site is listed twice on the ad. But ONE of those links is fraudulent! Do you see which one?

(Ha, ha, I made this illustration myself so it’s really pretty hard to notice the discrepancy. But keep looking until you see what “wrong” with that link. Still no luck? “Answer” is at the end of this Advisory.)

Let’s move on from these detailed examples to ways that they are used for top scams and frauds “in action” today.

Message from your bank

Scammers use the same techniques that we’ve already described, getting you to click on a link from “your bank” that takes you to a fake but very familiar-looking website where they ask you to confirm your account number, your login, etc.

This scam may even include a telephone call prompting you to share the same information.

If you receive an email or a call from your bank, do not respond via the message. Instead, go directly to the bank’s website and log in the way you normally do.

Zelle transfer into fake Zelle account

Selling something online? A buyer may insist that you use a Zelle transfer. The entire transaction will end up being accompanied by a fake confirmation from “your bank” that “their deposit” has been made. You ship the item.

Of course, they have never sent you anything except fake emails.

Note: Zelle is a legitimate company that makes it easy to transfer money from account to account – certainly, to friends and family. But think twice if strangers want you to use it. There are other ways to get paid.

“Uh, oh. You have a problem” messages from known companies or organizations

There is no reason for your bank to send you an SMS text about your credit card being blocked. Amazon doesn’t call to let you know “your purchase has been approved.” Utility bills may seem high, but no representative will offer to “stay on the line with you so you can make a payment right now.”

And the IRS writes letters. It doesn’t call unless you’ve made an appointment.

Long-running scams based on human nature

Scammers know all about how to inspire fear, greed, hope and sympathy. Some of the most persistent scams are built around these emotions. Under the right circumstances you could get caught.

- False charities: “Support the orphans of the war in Ukraine”

- “Fill out this survey and be entered to win an iPhone!”

- “Grandma, help! I’m in Baja California and I’ve been arrested!” (I got this one!)

- “Can you help me out by buying some gift cards?” (Two of my neighbors got this one.)

- “Lonely? Looking for a new friend?” (Romance fraud is the second most costly fraud of all.)

And some especially popular frauds from 2020 and 2021

- Fake auto warranties and fake calls from car insurance companies

- Technology “alerts” (“We’ve detected a problem with your computer . . .”)

- Social Security and Medicare (“. . . need your social security number to check . . .”)

- Cryptocurrency fraud and scams (So many tricky ways to lose money here it demands its own full article. A couple of the scam names give you an idea: “Pig butchering,” “Pump and dump,” “Rug pulls,” and “Airdrops.”)

Is there a reliable way to protect against scams and fraud?

With so many threats out there, it’s hard to know just what to do. The FBI and other anti-fraud organizations provide these recommendations. I’m sure you’ve heard them all before. The trick is to keep them always in mind!

- Don’t click on links in strange emails or even open them in the first place without closely examining the return address, the signature, the language – and the offer.

- Don’t answer phone calls from strange numbers or even from what look like local numbers. Let whoever’s calling leave a message.

- If you get a call or a message telling you about “an urgent problem,” hang up. Take the time to call the organization yourself, from a number you know is good.

- If the deal sounds too good to be true . . . well, you know about that!

If I’ve been scammed or defrauded, can I get my money back?

As always, it depends. But you need to start by knowing the difference between a fraud and a scam.

Fraud. If someone gets access to one of your accounts and makes a payment or withdrawal without your permission, and you were not involved in any way – that is considered fraud. Report it to the appropriate authorities. You will typically be able to get your money back.

Scam. If, however, you were involved in any way in the transaction – even if you were tricked or misled – that is a scam. You may not be able to get your money back. (There may not even be any “appropriate authority” to report to.)

With this knowledge, you can head to the Consumer Financial Protection Bureau, where next steps are listed for victims of a variety of different scams and frauds. https://www.consumerfinance.gov/consumer-tools/fraud/

Still raising your hand as “among the best” at detecting and avoiding scams and fraud? Congratulations! Maybe you can share your own best practices with the rest of us?

Virginia

Your Emergency Plan Guide team

P.S. If you didn’t quite see the difference between the two links in the 50%-off ad, it is hidden in the second link. See that “a” in the word “safe?” Compare it to the “a” in “sale.” Two different typefaces for the same letter?! Not likely! (I couldn’t even get WordPress to let me “misspell” it here!)

P.P.S. I checked. About 2 years ago I wrote an Advisory on some of these same topics. The statistics were a whole lot less shocking, though! And that article touches on Identity theft, another aspect of fraud. You may want to check it out here: https://emergencyplanguide.org/protect-yourself-from-identity-theft/