Will insurance cover it? Wait til he sees the fine print. . .

Have you ever just had a plain, bad week? Like this guy in the photo, car broken down miles out in the desert. Will his roadside assistance even come to help him, this far away from anything? What do you bet he has never read the fine print . . .!

This photo instantly reminded me of the older Prius we drove some years ago. Its battery died at 154,000 miles. We confidently pulled out the warranty. When we read the fine print on that one, sure enough. It had expired at 150,000 miles!

The point of these examples: It’s always a good idea to know what your insurances really cover . . . and when it’s time to make some changes.

So let’s take a quick look at some coverages you may have been taking for granted.

Let’s start with the small print of Roadside Assistance.

When I was a kid, and the ’37 Chevy stopped running, my Dad would get out, raise the hood, and was almost always able to get things working. At least, we got to the nearest garage. Today, though, drivers old and young are pretty much thwarted by the modern car’s computers. Their only option: Roadside Assistance!

I personally couldn’t get along without it. (If you don’t have it now, consider getting it. Check first with your insurance company, then with an organization like AAA or Good Sam, maybe even with a premium credit card where it could be included for free. As with everything related to insurance, coverage and prices vary.)

With the man in the photo still in mind, I took a quick look at the “towing limits” for my own program and coverage from several other roadside assistance programs. They varied widely! One covers costs of a 5-mile tow (pretty much useless, I would think) to a 1,000 mile tow to a tow to “the nearest qualified repair facility.” (How do they define “qualified?”)

So questions you should be asking about roadside assistance for your own car or cars:

- What is actually covered?

- What (or who as driver?) is excluded?

- How much are you paying, and does it make sense given your car and your driving habits?

Next, let’s take a look at Health Insurance, on my radar since I got an update from my own plan last week.

(How often do you get updates from your own insurance? How often do you actually read them? I admit to filing most.)

This report caught my attention because it was about “Getting Care During a Disaster.” If they are sending me a special report on this topic, I assume coverage might not be what I would normally expect! Close examination led me to these interesting facts:

- A “disaster” is only a disaster if the state governor, the U.S. Secretary of Health and Human Services, the Centers for Medicare & Medicaid Services or the President of the United States declares it. (A localized flooding or fire may not reach “disaster” proportions.)

- My insurer will try to keep facilities open and will post schedules and access info online. (Not going to be very helpful if there is a widespread power outage . . .)

- If I can’t get to my insurer’s regular facility or office or pharmacy, I was pleased to see that I can get care elsewhere, without a referral or prior authorization, and will only have to pay my usual amount.

Once the disaster is over, however, or after 30 days have passed and there is no end date declared, I’ll be on my own if my provider hasn’t been able to re-open!

So these questions should immediately come to your mind:

- How does my insurance carrier define emergency?

- Where can I get care if my usual doctor’s office or pharmacy is closed?

- What WON’T be covered in an emergency?

Makes you think about taking another first aid course, doesn’t it?!

Finally, what about a longer-term emergency at my workplace?

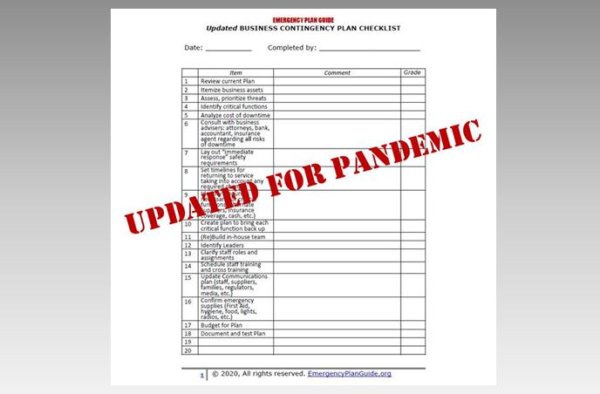

Small businesses, in particular, are often so busy keeping everything going day to day that they simply overlook anything beyond standard property and liability insurance.

Here at Emergency Plan Guide, we have looked more closely at what happens when you experience a business interruption. As you might expect, business interruption insurance has even more than its share of fine print.

Basic business interruption insurance is meant to help support the business and you only for “covered perils.” So, anything not listed as covered won’t be covered!

Reading the fine print may reveal that some interesting things are NOT included in “basic covered perils.” For example . . .

- Utility service interruption may be covered (as an add-on) – but it may not cover you if power to the business comes through overhead transmission lines.

- If your business is only partially closed, but customers can find a way to get in, your business interruption insurance may not kick in.

- What if your business is closed due to a cyberattack? Given that small businesses seem to be the target of most data breaches (43% of all of them in 2019), this is protection you need to consider. However, note that you may not be able to get coverage if your business hasn’t set up industry best practices for protecting your data and computer systems.

The above details are random examples, selected to make the point about knowing exactly what your various insurance policies cover. As you review that fine print, check for a waiting period before the coverage takes effect . . . or an end period after which it stops. And all insurance coverages may include deductibles and/or maximums.

It’s up to you to fit the policy to your own likely needs.

Insurance is an essential piece of your emergency preparedness. But you can’t rely on last year’s policies!

These days we are experiencing such rapid changes – from weather to first-ever political and public health events. Values are rising and falling in unprecedented fashion. New insurance coverages are being developed while others are shrinking or have even disappeared!

Staying on top of your insurances takes more effort than every before. If you haven’t done a recent insurance review, September is a good time to get one scheduled and dig into the fine print of each of your policies. After all, it is “Emergency Preparedness Month!”

Good luck!

Virginia

Your Emergency Plan Guide team

P.S. It pays to remember the underlying fact about insurance: the agent works for the insurance company, and not for you. The more you know about your situation, its peculiarities, and way insurances work, the better you’ll be able to work with the adjuster when you have a claim. If you have a very big claim, you may want to consider hiring a private adjuster to represent your interests.

P.P.S. There’s more about insurances here on our site, by the way. You can check on these Advisories:

- How to do an insurance inventory of personal possessions: https://emergencyplanguide.org/take-an-insurance-inventory/

- Another look at flood insurance: https://emergencyplanguide.org/flood-damage-not-covered-by-insurance/

- Seven questions to ask your insurance agent: https://emergencyplanguide.org/covered-for-a-natural-disaster-or-not/